venmo tax reporting for personal use

The best way to avoid having personal transactions reported to the IRS is to use separate Venmo accounts for personal and business transactions. However if youve already co-mingled.

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

E-File Your Tax Return Online.

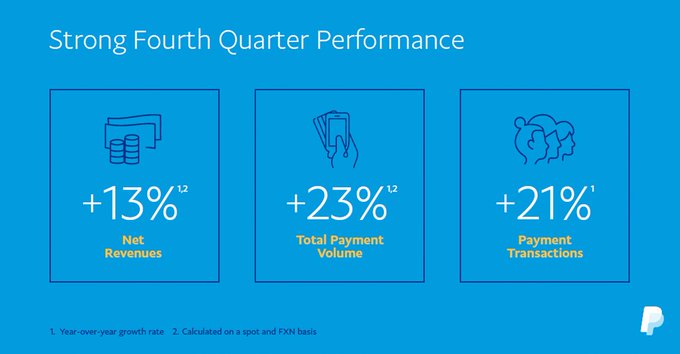

. Just Fill Out Your Info Including Your Mobile Number Get 10. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year. If you use PayPal Venmo or other P2P platforms.

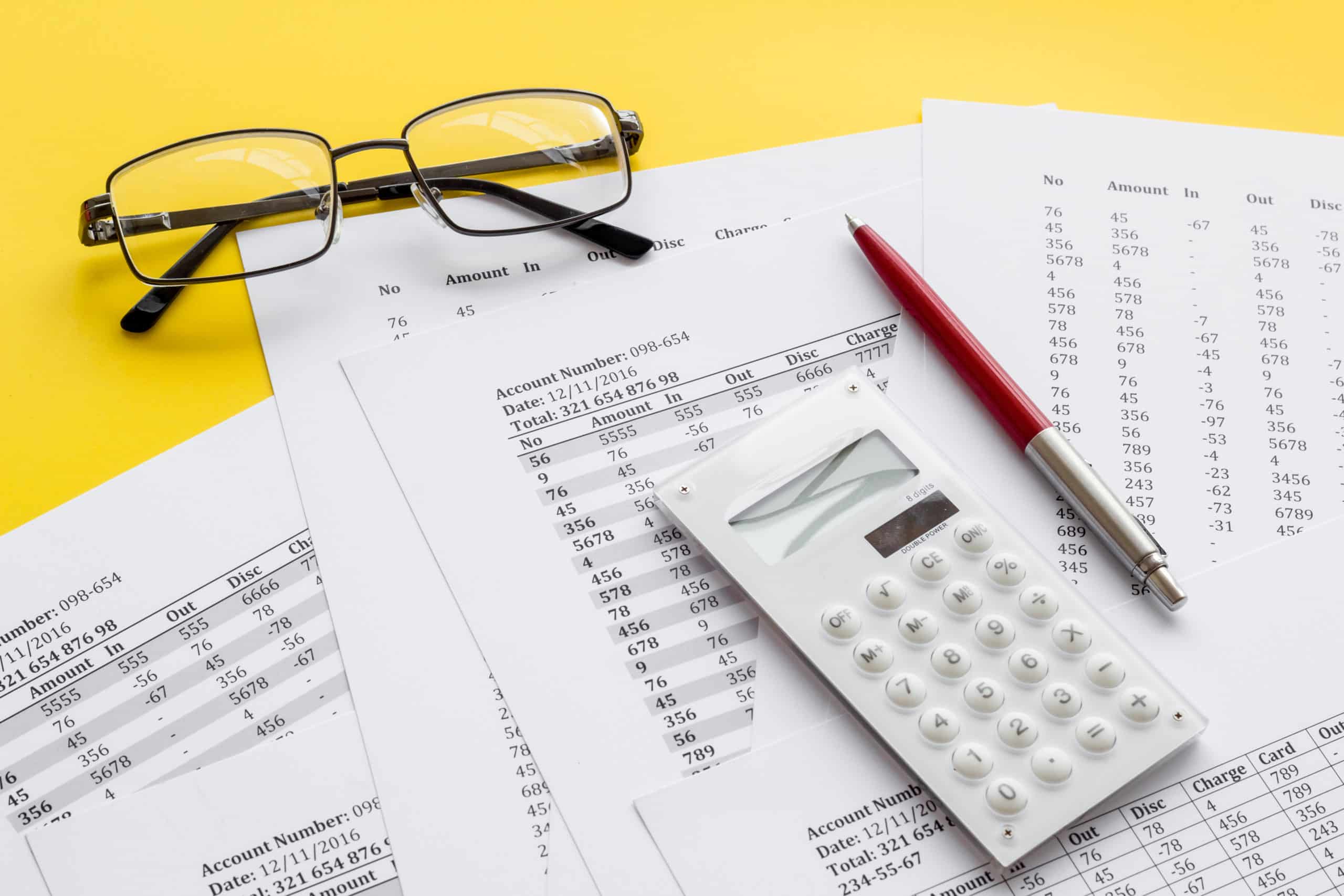

Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. Even if you didnt receive a Form 1099-K in the past you should have reported the taxable income you received. Generate clear dynamic statements and get your reports the way you like them.

Venmo tax reporting for personal use 2022 Thursday August 18 2022 Before 2022 the minimum threshold for reporting business transactions in a tax year was 20000 in. It allows you to easily split rent with your roommate. Ad Create and Send Professional Invoices and Receive Payments Online.

Many people use Venmo strictly for personal transactions the company reports that the average payment amount is 60. Heres the tricky part. This new tax rule only applies to payments for goods and services not for personal payments between friends and family.

Ad Our tax preparers will ensure that your tax returns are complete accurate and on time. But as soon as you begin to use Venmo for payment transactions for goods and services you are responsible for reporting it to the IRS come tax time. Venmo Tax Reporting For Personal Use Does Venmo Report To Irs.

Generate clear dynamic statements and get your reports the way you like them. Ad Save time and increase accuracy over manual or disparate tax compliance systems. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year.

A business cant use a personal account because it doesnt provide the necessary tax records. Ad Create and Send Professional Invoices and Receive Payments Online. If you need help to.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Previously the threshold was 20000 in. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes.

Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. Anyone who receives at least. The Internal Revenue Service is cracking down on people who underreport earnings received through digital payment apps such as PayPal Venmo Cash App Zelle and others.

For most states the threshold. Well explain how to handle Venmo transactions and the taxes you need to be aware of. Managed services from Sovos makes your sales tax filings quick easy and painless.

In this guide well be exploring Venmo 1099 taxes. 20 hours agoReceiving a 1099-K and reporting income from payments received on a peer-to-peer. Rather small business owners independent.

Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year. The new tax reporting requirement will impact your 2022 tax. Venmo tax reporting for personal use 2022 Friday February 18 2022 Edit.

If you are required to file a tax return you must report all income. If you use Venmo for example to receive payment from a. A business transaction is.

Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. The IRS views the payment andor receipt of money through Venmo or any similar peer-to-peer P2P app the same as a traditional payment andor receipt of cash. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

New Irs 1099 Rule For Paypal And Venmo Targets Very Small Businesses And Will Cause Misreporting And Errors

Ebay Sellers Face 1099 K Tax Headache Under New Irs Rule Bloomberg

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed

Using Venmo For Business What You Need To Know Finli Finli

If Your Business Uses Venmo Read This Now Mobile Law

Did You Sell An Old Desk Online You May Receive A Tax Form The New York Times

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Why You Shouldn T Use Apps Like Venmo And Paypal For Payroll Everee

How Using Paypal And Venmo Affects Your Taxes As A Freelancer

New Tax Implications For Hobbyist Sales Using Payment Apps Correct

The Taxman Cometh The Irs Wants In On Your Venmo

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

How Safe Is Venmo And What Are Its Fees

Paypal Taxes 2022 How Big Are The Transactions This App And Venmo Report To The Irs Marca

Venmo Paypal And The Irs Here S What You Need To Know

Do I Have To Issue 1099s To Independent Contractors Paid Via 3rd Party Vendors Updated 4 5 22